![]() Unlike the other investments I have made and written research about on this website, I found Hallmark Financial through a friend. Rijk had some valuable insight into this business and passed it along (as he has with many other companies- it’s hard to keep up with his work ethic!) The recommendation threw me for a loop; it was in a new industry I knew absolutely nothing about- insurance- but after seeing the success Buffett and Watsa have enjoyed in the industry, I was very interested to get learning.

Unlike the other investments I have made and written research about on this website, I found Hallmark Financial through a friend. Rijk had some valuable insight into this business and passed it along (as he has with many other companies- it’s hard to keep up with his work ethic!) The recommendation threw me for a loop; it was in a new industry I knew absolutely nothing about- insurance- but after seeing the success Buffett and Watsa have enjoyed in the industry, I was very interested to get learning.

Hallmark Financial is in the property/casualty industry and is primarily located in Texas, with many other states only composing 5% or less of premiums written. Hallmark underwrites underserved niche areas that generally have much less competition and this leads to better underwriting performance than the industry averages. Their policies are highly customized and their underwriters have 15 years of experience, on average. They insure “short-tailed” risks, referring to the time period between the premium received and the claim paid out. These risks are low in severity and generally much easier to predict and price than “long-tailed” risks. The main issue with these short-tailed insurers is that some do not generate a good amount of float in relation to premiums written. This is because the claims are paid out so quickly that it leaves little time for investment. Hallmark generates about $1.00 of float for each dollar of net premiums written, so I consider this a good thing year over year. I’m not sure how this compares to the industry, but at least it’s not a small percentage of written premiums. Buffett talks about this in his 1996 shareholder letter.

Macro

I do keep track of macro factors, but tend to give them little piece of mind in most investment situations. I am more concerned with macro factors ruining the businesses I’m investing in than helping them, but with this case, Hallmark will be helped by the macro factors surrounding the industry in the long run.

Today’s low interest rate environment affects insurance companies adversely in a few ways. The main issue is the interest obtainable on the fixed income portion of their portfolios. As a result, the investment income is much lower than it would be at more “normal” historical levels. Interest rates are only bound to go up in the long run from here (I’m not making a bet on when it will occur, only that it will eventually). This provides some serious upside for Hallmark, whose portfolio has consistently been composed of 90% fixed income securities. The portfolio size is about $400 million, so even a 2% shift in interest rates could increase the long-term profitability by $8 million (average annual adjusted cash flow is $35 million, this is a sizeable increase indeed). The other issue with interest rates being so low is the policyholders’ liabilities. These can be somewhat overstated with lower interest rates, because they are discounted (time value of money) at prevailing interest rates to today. The lower the discount rate, the higher the liability’s value today. I do not believe this materially affects Hallmark, but it is something to note for the industry.

In addition to the eventual upside with the interest rate environment, the property/casualty insurance industry is in the midst of its seventh straight soft market. This means that the industry is in a period of intense competition and premium rates tend to be low, profitability shrinks, and high capital bases exist. Once the market hardens, and insurance companies tend to become much more strict about their underwriting standards, premium rates can rise as quickly as 30-40% per annum while taking on the same risks as the year before. Hard markets are what insurance companies live for and many people in the property/casualty industry are hoping the insurance market turns soon.

Effectively, investing in Hallmark today is like buying at the bottom of two separate industry downturns. This soft market is hurting the industry, especially considering the average P/C combined ratio was 101% for 2009 and it worsened slightly in 2010. It is nice to know that although the industry is facing headwinds today, the ultimate tailwinds once one or both cycles switch will provide a nice upside for Hallmark.

Management

I believe the management at this company is very solid and I have a lot to say about them. Stock options for the executive management currently vests until 2016-2019 and comprises about 40% of their annual compensation. In addition, the Chairman of the Board, Mark Schwarz, owns about 43% of the company through his hedge fund. Not only does he have a sizeable stake in the company, it is also a sizeable position in his hedge fund’s $200 million portfolio at about 38.4% of his portfolio. His next largest position is 5.6%, so this is clearly his most prized asset. This will cause him to act as an owner when making decisions. Schwarz has been buying up stock in Hallmark over the past 12 months at prices ranging from $8.73 to $8.85 and this added to his position by about 5.6% for the year. The current stock price is $9.00, so you can buy in at very similar prices.

Mark Schwarz is the General Partner at Newcastle Partners and has averaged an annualized return of 27% for a 12-year period ending in 2007. I could not find any results more recent than that. I was fortunate to get a chance to speak to him over the phone and ask some questions. His investment philosophy is very much tied to Graham/Dodd and buys companies based on underlying fundamentals. This was great to hear, considering Schwarz personally manages the entire portfolio at Hallmark. He has been known to become an activist investor, buying up stakes in companies, such as Hallmark in 2000 or Pizza Inn Inc in 2003, getting rid of old management, and fixing up the companies to build long-term shareholder value. Pizza Inn hasn’t yet been a success, but Hallmark is doing quite well since his initial purchase in 2000. I have included some of Mark Schwarz’s comments throughout this report for certain aspects of the business. Here is an excerpt from his shareholder letter in 2009:

“The deeply discounted price for Hallmark shares is not completely unique, as the share prices for property and casualty insurance companies in general remain out of favor and represent perhaps the most undervalued sector in public equity markets today. We turned this phenomenon into a temporary advantage during the third quarter through the buy back of 3.6% of our outstanding common stock at $7.00 per share, a price equal to 62% of year-end book value per share. The shared pain of a market price that does not reflect the intrinsic value of our company is felt by all stockholders.”

Although investors should normally run when a stock is so blatantly advertised in the annual report, I believe this is just an example of Schwarz showing his shareholders he wants to be as upfront as possible. Besides, the company only has 3 analysts and it has a market cap under $200 million. You have to think about how many people are actually reading this annual report as potential investors vs. how many are already shareholders. This message was directed mostly towards current shareholders in my mind.

Mark Morrison has been the CEO since 2006, has been at the company since 2004, and holds about a 2% stake in the company through future stock options. He has been a manager in the insurance industry since 1991 with more than 28 years of experience; it’s great to see that Schwarz didn’t just take a high-profile CEO to manage the company. I was also fortunate enough to speak to Mark Morrison over the phone and get his mindset on Hallmark. He is very similar to Mark Schwarz in terms of high intelligence and thoughts on the business moving forward, and I will include his thoughts throughout this report.

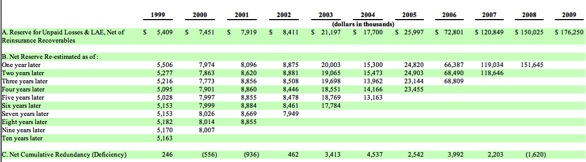

As has been discussed by many great security analysts of the insurance industry, one must be certain of the management before investing. This is why I reached out to both the Chairman and the CEO and worked hard to talk to both of them. Speaking to them gave me a better sense of what to expect in the future, their thoughts on capital allocation, the recent problems with underwriting standards, and their overall disposition towards the business. The reason one must be certain of management is because the Income Statement includes many estimates and assumptions about future claims to be paid out. Some claims can take many years to settle, so estimations are necessary to match revenues (premiums earned) to costs (losses & LAE). It would be very easy for management to be aggressive and report high profits for a few years (by aggressively estimating lower losses than will actually occur in the future), only to have the company collapse inward on itself with large losses in the future. The table below will show you how well the company has done in estimating ultimate underwriting losses & LAE:

The way this table works is that management takes a guess at the ultimate losses that will be paid out based on the premiums written for the year. This goes on the Income Statement and is labeled “A. Reserve for Unpaid Losses &…” on the table above. As additional claims become settled, the table is adjusted. As you can see in the very bottom row, the cumulative redundancy or deficiency is very consistent and doesn’t include any major errors. Ravi Nagarajan of rationalwalk.com wrote about this being important in his article:

“When an insurer revises prior loss estimates, prior financial statements are not retroactively modified to reflect these changes. Instead, the re-estimated amounts are reported in earnings over time as components of loss and loss adjustment expenses. This means that each year, the underwriting loss figure reported to shareholders may include revisions to prior estimates as well as current year developments.

Shareholders should not want to see either overly optimistic assumptions leading to a cumulative deficiency or overly conservative assumptions leading to a cumulative redundancy. The goal should be to estimate losses as accurately as possible. Given the uncertainty involved in estimating ultimate losses, particularly in reinsurance lines where ultimate payouts will not be known for decades, it is unrealistic to expect perfection.”

The results of the last few years are still not fully settled, but in judging past results, it seems as though management has done a great job with their estimations. Couple that with the heavy inside ownership (and continual buying at today’s stock price) and you can believe these losses are well-reserved moving forward.

The mindset of both Mark Morrison and Mark Schwarz (CEO & Chairman, respectively) toward capital allocation is one of balance. They repurchased shares at bottom-of-the barrel prices when they don’t need the extra capital, as in 2009, when they repurchased 750,000 shares (3.6% of company) at $7.00 per share. However, they do not plan on repurchasing shares or paying dividends soon. This is because the ability to grow is only limited by the policyholder’s surplus of the company. Hallmark needs to maintain a 300% or less premium-to-surplus ratio, meaning they can only write 3X the amount of premiums as the policyholder’s surplus they have on the balance sheet. Management does not want to miss out on the next hard hard market, when premiums can grow 30-40% per year, just because they used up too much capital today. It is better to earn a reasonable return on investments or look for acquisitions while waiting for the market to turn, instead of trying to maximize shareholder value in the short-term. This is very much a long-term shareholder value orientation and I am very pleased to see this.

There have been two instances of rights offerings from company’s management since 2000. The first was done in 2003 and was used to repay a loan used to purchase a troubled insurer. The second was used to shore up the company’s balance sheet and increase their A.M. Best rating from B+ to A-. Both of these rights offerings were done at around 65% of market prices; what this means is a major chance for shareholders to increase their stake in the company by using an “over-subscription privilege”. If other shareholders do not partake in the rights offering, you can purchase up additional shares below market prices, and although the stock will become slightly diluted, the market price will not fall below the rights offering price (assuming a somewhat rational market). Mark Schwarz used both of these rights offerings to continually raise his stake in the company. It was stated in both prospectuses that his holdings could reach as high as 80% after the offering. This did not happened because many of his fellow shareholders exercised their rights in the offering, but that isn’t to say he didn’t try. Needless to say, when you see a shareholder-controlled company offer a few rights offerings, you may want to participate. Otherwise you will be diluted out of your interest in the company and someone else is using your shareholder rights to increase their holdings at a lower cost basis. Pay close attention the next time this occurs- it is a good way for you to also increase your holding in the company at a lower price.

Underwriting

As I said above about the estimated reserves moving forward, shareholders in Hallmark do not have much to worry about (check the table & discussion above).

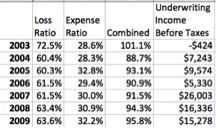

Hallmark’s underwriting has been consistently disciplined and well-managed. Here are their results from the last seven years:

As you can see, the expense ratio is right around 30% and the loss ratio has been consistently in the 60% range. Hallmark has shown consistent underwriting profitability since the latest beginning of the soft market in 2003. This means that Hallmark does not have to pay for its float, and instead, is actually paid to hold its policyholders’ money. This is a great situation because the investment portfolio is earning about 6% every year and, when coupled with the great underwriting results, means consistent profits.

In the shareholder letters every year, from both the Chairman and the CEO, statements are made about focusing more on underwriting profitability than top-line growth. As can be seen above, the combined ratio is consistently below 100% and the company has been living up to its promises of profitable underwriting. After having this first hurdle met of underwriting profitability, Hallmark then focused on growing book value year over year. It has grown at a compounded 16% annual return. They did have many acquisitions over the decade that contributed to this, as well as the two aforementioned rights offerings, but there is definitely a growth culture at the company that will continue into the future. Management has continually held to its underwriting standards until recently, where there have been some short-term problems, but I will discuss this later.

Hallmark’s underwriting has created a float today of about $270 million. For this calculation, I added together unearned premiums, losses & LAE reserves and subtracted out deferred policy acquisition costs, premiums receivable, and prepaid reinsurance premiums. This is a rough approximation that is basically the money received from policyholders that hasn’t yet been paid out in expenses or claims. This float does not cost them anything because they are consistently underwriting at a profit. It is very pleasant to see a $270 million dollar loan with no interest rate.

Investment Portfolio

Here is the current composition of the portfolio:

Mark Schwarz manages the investment portfolio himself and does a very good job. I voiced my concerns about the municipal bond portion of the bond portfolio because of comments I’ve seen concerning municipal bonds from many investors. Here is Prem Watsa discussing municipal bonds (from Q3 transcript earnings):

So we’d buy airports and we’ll buy water systems, essential services that even if you have a problem in a certain municipality, these are things that just have to be backed by the federal government. So, airports, water systems, transportation systems, and – and broadly speaking, we don’t go with general obligation bonds. And so that’s how we are managing our portfolio. We like the yield. And so you have to be careful, though. It’s very treacherous to muni markets, particularly today. And so each one of these bonds are analyzed by us.

Mark Schwarz said they do not own any general obligation bonds. He also reiterated that all the muni bonds, and every other security in the portfolio, were hand-selected by him and he believes the selection is safe. His hedge fund at Newcastle Partners is composed almost entirely of equities, which contrasts with the 90% position in fixed-income for Hallmark. I believe this major difference comes from the “stress tests” that state regulations have when analyzing the credit-worthiness of these insurance companies. Equity securities are often marked down as much as 40-50% when looking at how solvent the company is. States need to keep this possible stock market crash in mind because their citizens need to be insured by solvent companies. To keep their A.M. Best rating of A-, the debt securities will have to remain in the portfolio. Because of the mostly fixed income portfolio, shareholders should not expect to see anywhere near the 27% annualized that Newcastle has achieved, but should still expect a reasonable return on this portfolio. It is helpful to note that the portfolio is managed by someone very capable who has his money and reputation on the line.

Short term problems

Overall, the short-term problems came from two of their three segments. The Personal lines of insurance have been consistently growing since 2003 and have always been profitable. Recently, the company slightly gave up on its pure underwriting profitability approach and decided to expand more quickly, causing losses the last two quarters. Mark Morrison said there were some underwriting issues in Florida, but that after many of the bad agents are removed and the risks become more predictable in the new regions they expanded into, the segment will return to normal underwriting profitability. He had absolutely no concerns with the Personal lines and seemed very optimistic about its future. This segment has huge possible future expansion possibilities, considering it is only in a few states. It is a niche underwriting business with little competition; I see this as one of the main drivers of growth in the future. I’m just hoping that growth is not done at the expense of profitability, the way it has happened this year. Look for this to continually grow into the future.

Mark Morrison also talked about the Standard Commercial losses. He said he felt the reserves were adequate for the recent quarters at the Standard lines and that there was simply some bad luck with two hailstorms in Montana. “Unprecedented” is the word I keep coming across throughout press releases and company presentations for the amount of losses incurred in the last two quarters. Compared to the premiums received, especially in Montana, Morrison felt the losses were catastrophic. There was also a hotel that was burned down by an arsonist recently escaped from prison. He said there is no chance of pricing that type of thing into their results and it was just plain old bad luck. Both of these hits to underwriting are short-term in nature and should not be regarded as “the new normal”. I have full faith in this company to return to its former profitability.

To better visualize this, you can see the quarterly results from the last three years. You will notice a very consistent combined ratio resulting from disciplined underwriting. Unfortunately, the last two quarters have seen a large uptick in how many losses were incurred (you’ll notice the expense ratio is virtually unchanged), and this caused the slight deterioration in their underwriting results. Even with some underwriting losses for the 9-months ended this year, the cost of the float the company has is about 0.1%. The losses are small, and with a portfolio return of about 6% annually, this is hardly a major problem right now.

The first thing to focus on is downside risk. Although I did not include the reinsurance results in this report, I encourage you to examine the reinsurance the company takes out. They are very limited in their exposure to any one-time losses, but rather will lose money by paying many small claims. All of this is discussed in detail in Note 6 to the 2009 annual report and is worth reading.

When you think about more small claims being paid out each year while management prices the risks incorrectly, the odds seem very slim. Yes, a catastrophe or two down in the Texas area could create some serious problems, but there is not a likelihood of one very large plane or car crash that will hurt them terribly. Also, Hallmark’s balance sheet is very conservative, with only $56 million in debt and it is due in 25 years; it is easily covered by two years of earnings. Because of the well-managed reinsurance and the conservative balance sheet, Hallmark has a low chance of bankruptcy in the next few years. This limited downside will allow all shareholders to sleep well at night.

As for valuation, I will include a few metrics here because I still do not fully grasp how to value an insurance company. I can, like Ben Graham once recommended, estimate when a woman is overweight or when a man is old, even if I don’t know the exact amount of pounds or years. The same goes for Hallmark- I know it is undervalued based on earning power and book value, but I couldn’t tell you exactly what “fair value” is for the company. I plan on being a long-term shareholder.

I have conservatively estimated Hallmark’s earning power at about $35 million per year. This may very well not materialize for year-end 2010, due to the short-term problems discussed above, but this is where I see their profitability at today. Considering a purchase price in the market at $180 million, this leads to a 19.4% annualized return. Book value has been growing at 16% per year, and although some of this was created through rights offerings and acquisitions, they were made at sensible prices (a few acquisitions were made of companies in default at ½ book value) and used minimal amounts of debt. Hallmark’s tangible book value (after subtracting out intangibles and adding back in tax savings from amortization) is about $180 million. This leads to a purchase price at book value and you are receiving the future growth for free. Buying into Hallmark, as Mark Schwarz has continually been doing, will create about a 20% annualized return, perhaps better, from today’s prices. In essence, this investment is a bet on Mark Schwarz’s ability to create more shareholder value in the future. Considering the size of his holding and the importance of the company to him, this is hardly an all-or-nothing bet. I feel very safe with this consistent business and the shareholder-oriented management.

Full disclosure: I own shares in Hallmark Financial.

Here is a pdf of this report: Hallmark Financial

Thanks for reading. Contact me with any questions you might have.

Since no one has told you yet (here or on SA): really impressive article. Thanks for digging into the nature of the muni portfolio. That’s something I’ve been curious about. Have you made any adjustments considering the State Auto deal?

Thanks again, Will

Will,

I’m a firm believer in Mark Schwarz’s ability to acquire distressed insurers- it’s something he’s done quite a few times now & it has worked quite well. I haven’t looked in-depth into the State Auto deal but I feel like it will be the same as all of his other purchases.. Thanks for your kind words. I want to warn you that I do not fully understand the P/C industry (with shifting capacity & competition every year), only that if the industry does decently well moving forward, HALL will be one of the companies that benefits above-average.